Statistical Tables | | The Shutdown, In Beige

| Trends at a Glance | |||

| (Single-family Homes) | |||

| Nov 25 | Oct 25 | Nov 24 | |

| Home Sales: | 181 | 264 | 200 |

| Median Price: | $1,490,000 | $1,499,000 | $1,563,500 |

| Price: | $2,167,433 | $2,236,538 | $2,068,730 |

| SP/LP: | 98.6% | 98.9% | 106.4% |

| Days on Market: | 25 | 24 | 29 |

| (Lofts/Townhomes/TIC) | |||

| Nov 25 | Oct 25 | Nov 24 | |

| Condo Sales: | 206 | 301 | 208 |

| Median Price: | $1,130,000 | $1,149,000 | $1,120,000 |

| Average Price: | $1,317,052 | $1,310,239 | $1,284,629 |

| SP/LP: | 99.3% | 95.9% | 98.5% |

| Days on Market: | 56 | 46 | 65 |

The

median sales price for single-family, re-sale homes was down 4.7%

year-over-year.

The average sales price for single-family, re-sale homes was down 3.1%

month-over-month. Year-over-year, it was up 4.8%.

Sales of single-family, re-sale homes fell 9.5% year-over-year. There were 181

homes sold in San Francisco last month. The average since 2000 is 214.

The median sales price for

condos/lofts

was up 0.9% year-over-year.

The average sales price was up 2.5% year-over-year.

Sales of

condos/lofts

fell 1% year-over-year. There were 206

condos/lofts

sold last month. The average since 2000 is 230.

The sales price to list price ratio, or what buyers are paying over what sellers

are asking, fell from 98.9% to 98.6% for homes. The ratio for condos/townhomes

rose from 95.9% to 99.3%.

Average days on market, or the time from when a property is listed to when it

goes into contract, was 25 for homes and 56 for condos/lofts.

Sales momentum…

for homes fell from +5.8 to +4.3. Sales momentum for condos/lofts was down 2.8

points to +14.4.

Pricing momentum…

for single-family homes fell 0.6 of a point to -2.4.

Pricing momentum for condos/lofts fell 0.1 of a point to –4.4.

Our momentum statistics are based on 12-month moving averages to eliminate

monthly and seasonal variations.

If you are planning on selling your property, call me for a free comparative

market analysis.

momentum by using a 12-month moving average to eliminate seasonality. By comparing this year's 12-month moving average to last year's, we get a percentage showing market momentum.

the blue area shows momentum for home sales while the red line shows momentum for pending sales of single-family, re-sale homes. The purple line shows momentum for the average price.

As you can see, pricing momentum has an inverse relationship to sales momentum.

The graph below shows the median and average prices plus unit sales for homes.

Remember, the real estate market is a matter of neighborhoods and houses. No two are the same. For complete information on a particular neighborhood or property, call me.

P.S. The FHA requires all condo projects to be re-certified before they will make a loan. To find out if the condo project you're interested in is eligible, go here: https://entp.hud.gov/idapp/html/condlook.cfm.

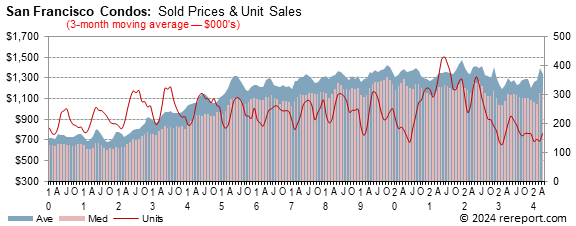

The graph below shows the median and average prices plus unit sales for condos/lofts.

The real estate market is very hard to generalize. It is a market made up of many micro markets. For complete information on a particular neighborhood or property, call me.

If I can help you devise a strategy, call or click the buying or selling link in the menu to the left.

Complete monthly sales statistics for San Francisco are below. Monthly graphs are available for each area in the city.

| November Sales Statistics | |||||||||||

| (Single-family Homes) | |||||||||||

| Prices | Unit | Yearly Change | Monthly Change | ||||||||

| Median | Average | Sales | DOM | SP/LP | Median | Average | Sales | Median | Average | Sales | |

| San Francisco | $1,490,000 | $2,167,433 | 181 | 25 | 98.6% | -4.7% | 4.8% | -9.5% | -0.6% | -3.1% | -31.4% |

| D1: Northwest | $2,130,000 | $2,668,056 | 18 | 44 | 118.2% | -11.3% | 8.3% | 38.5% | -3.2% | -2.2% | 20.0% |

| D2: Central West | $1,708,000 | $1,780,666 | 35 | 15 | 122.4% | 17.8% | 14.0% | -18.6% | 5.8% | -5.3% | 9.4% |

| D3: Southwest | $1,325,000 | $1,508,000 | 10 | 31 | 112.5% | -0.7% | 12.8% | -23.1% | 2.7% | 0.6% | -37.5% |

| D4: Twin Peaks | $2,240,125 | $2,349,279 | 26 | 26 | 111.1% | 14.9% | 2.0% | -21.2% | -1.5% | -2.0% | -16.1% |

| D5: Central | $2,597,500 | $3,393,350 | 26 | 24 | 105.2% | -0.5% | 8.6% | 23.8% | 15.4% | 31.3% | -46.9% |

| D6: Central North | $3,950,000 | $3,628,333 | 3 | 27 | 98.3% | 54.9% | 27.7% | -40.0% | 187.8% | 185.4% | -25.0% |

| D7: North | $5,400,000 | $7,325,000 | 8 | 75 | 90.7% | -11.5% | 19.1% | 14.3% | -29.3% | -12.2% | -50.0% |

| D8: Northeast | $4,225,000 | $4,544,629 | 3 | 17 | 108.7% | 28.0% | -50.4% | 0.0% | 89.0% | 116.7% | -25.0% |

| D9: Central East | $1,650,000 | $1,783,737 | 19 | 13 | 119.6% | 6.3% | 9.7% | -5.0% | -3.6% | -9.5% | -40.6% |

| D10: Southeast | $1,035,000 | $1,068,860 | 33 | 36 | 110.6% | 5.1% | 4.1% | -21.4% | 3.6% | -1.1% | -8.3% |

| November Sales Statistics | |||||||||||

| (Condos/TICs/Co-ops/Lofts) | |||||||||||

| Prices | Unit | Yearly Change | Monthly Change | ||||||||

| Median | Average | Sales | DOM | SP/LP | Median | Average | Sales | Median | Average | Sales | |

| San Francisco | $1,130,000 | $1,317,052 | 206 | 56 | 99.3% | 0.9% | 2.5% | -1.0% | -1.7% | 0.5% | -31.6% |

| D1: Northwest | $1,426,000 | $1,386,161 | 14 | 59 | 104.2% | 24.8% | 23.8% | 40.0% | 5.6% | -7.6% | 0.0% |

| D2: Central West | $1,300,000 | $1,293,750 | 4 | 28 | 109.8% | 10.6% | 11.9% | 33.3% | -16.7% | -10.4% | 33.3% |

| D3: Southwest | $890,000 | $890,000 | 2 | 22 | 99.7% | 27.1% | 27.1% | 100.0% | 25.4% | 36.7% | -33.3% |

| D4: Twin Peaks | $1,325,000 | $1,325,000 | 1 | 21 | 106.0% | 130.4% | 127.6% | -75.0% | 31.2% | 49.5% | -80.0% |

| D5: Central | $1,500,000 | $1,505,850 | 29 | 34 | 108.8% | 0.3% | 0.2% | -17.1% | 4.7% | 8.0% | -17.1% |

| D6: Central North | $1,192,500 | $1,269,819 | 24 | 55 | 108.9% | 4.3% | 11.2% | -7.7% | -0.6% | 2.4% | -17.2% |

| D7: North | $1,945,000 | $2,069,077 | 26 | 33 | 102.1% | 30.8% | 7.9% | 8.3% | 16.1% | 0.8% | -21.2% |

| D8: Northeast | $1,005,000 | $1,179,411 | 46 | 57 | 100.2% | 13.7% | 10.6% | 70.4% | 1.5% | 9.9% | -6.1% |

| D9: Central East | $900,000 | $1,205,786 | 55 | 75 | 99.9% | -12.2% | -5.4% | -16.7% | -15.1% | -5.9% | -30.4% |

| D10: Southeast | $710,000 | $719,600 | 5 | 84 | 99.3% | 13.0% | 3.7% | -58.3% | 9.2% | 18.0% | 66.7% |

November 26, 2025 --

So-called "hard" economic data continue to trickle out from government sources

again, but much of it is months old at this point. While helpful, it is only

when data comes available to bridge the October-November shutdown gap that

changes to trends -- if any -- will become evident.

Seeing as to how September's sales were already the second highest annualized

monthly figure this year (4.10 million), it is likely that we'll see sales

trending toward perhaps a 4.15 to 4.19 million pace when existing home sales are

tallied for the closing months of 2025. Inventories of homes to buy have

improved and home prices are just burbling along, so if mortgage rates can

manage a broad softening trend to close the year and start 2026, we may start to

see some regular improvement in home sales even before the spring homebuying

season kicks in.

Mortgage rates have mostly been drifting sideways in recent weeks, but at least

they are doing so at about a one-year-low level, give or take a little. Absent a

plummet in rates, the onset of the holiday season will tend to damp mortgage

activity, but there was a 0.2% increase in requests for mortgage credit in the

week ending November 21. The Mortgage Bankers Association reported that there

was a 7.6% increase in applications for funds to purchase homes (perhaps

presaging a November increase for the Realtors' PHSI) while refinancing activity

fizzled out by 5.7% for the week, a fourth straight decline for this component.

To get refinancing rolling again, rates will have to trend to (or below) the 6%

mark, opening up the window for the next group of homeowners. If or when rates

can actually manage to crack the 6% mark again, it will be for the first time in

more than three years.

While they aren't likely to manage a move that will get them to the 6% mark (let

alone below) over the next week, mortgage rates do appear to be poised to

decline a bit more. The influential yield on the ten-year Treasury has flirted

with the 4% mark a number of times this week, and spreads have thinned out a bit

of late. Combined, they suggest that we will see a 5-7 basis point decline in

the average offered rate for a conforming 30-year fixed-rate mortgage as

reported by Freddie Mac next Thursday.

This page is copyrighted by https://rereport.com. All rights are reserved.