Statistical Tables | Uncertainty Delays Opportunity

| Trends at a Glance | |||

| (Single-family Homes) | |||

| May 25 | Apr 25 | May 24 | |

| Median Price: | $1,350,000 | $1,350,000 | $1,375,000 |

| Average Price: | $1,458,918 | $1,457,777 | $1,502,160 |

| Home Sales: | 705 | 675 | 775 |

| SP/LP Ratio: | 106.9% | 107.7% | 110.3% |

| Days on Market: | 22 | 20 | 17 |

| (Condos/Townhomes) | |||

| May 25 | Apr 25 | May 24 | |

| Median Price: | $720,000 | $737,500 | $800,001 |

| Average Price: | $770,340 | $782,416 | $853,052 |

| Condo Sales: | 193 | 224 | 235 |

| SP/LP Ratio: | 100.8% | 101.6% | 103.7% |

| Days on Market: | 30 | 31 | 27 |

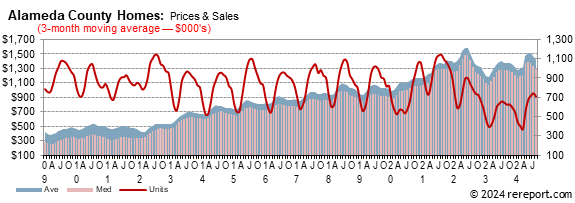

Sales of single-family, re-sale homes fell 9% from last year. There were 705

homes sold in Alameda County last month. The average since 2000 is 921.

The average sales price for

single-family, re-sale homes fell

2.9%

year-over-year.

It was up 0.1% from April.

The median sales price for

single-family, re-sale homes was down 1.8% year-over-year.

It was flat from April.

The sales price to list price ratio fell from 107.7% to 106.9%.

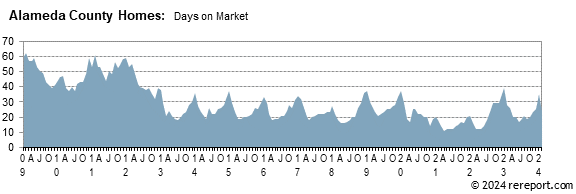

Homes sold in twenty-two days. This is the time from being listed to going under

contract.

The average sales price for condos was down 9.7% year-over-year. It was down

1.5% from April. The median sales price was down 10% year-over-year and it was

down 2.4% month-over-month.

The sales price to list price ratio for condos dropped from 101.6% to 100.8%.

Condo sales were down 17.9% from last year. There were 193 condos sold.

Condos sold on average in thirty days.

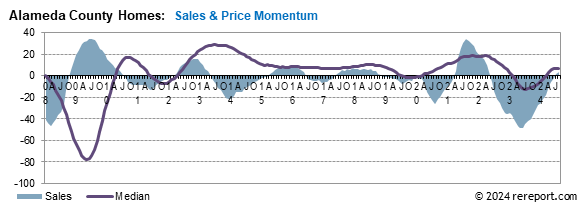

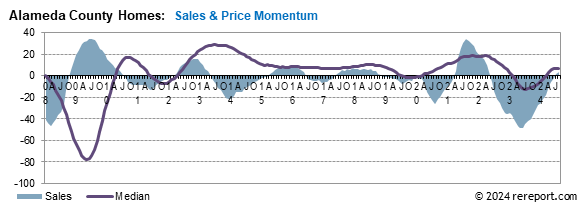

Momentum Statistics

Sales momentum…

for

single-family homes fell 1.8 points to +7.6.

Pricing momentum…

for single-family homes was down 0.8 of a point to

+0.2.

Our momentum statistics are based on 12-month moving averages to eliminate

monthly and seasonal variations.

This is an extraordinarily tough market for buyers. It's important to be calm

and realistic. If you don't know what to do or where to begin, give me a call

and let's discuss your situation and your options.

If you’re looking to sell, call me for a comprehensive Comparative Market

Analysis.

Our momentum statistics are based on 12-month moving averages to eliminate monthly and seasonal variations.

This is an extraordinarily tough market for buyers. It's important to be calm and realistic. If you don't know what to do or where to begin, give me a call and let's discuss your situation and your options.

If you’re looking to sell, call me for a comprehensive Comparative Market Analysis.

the blue area shows momentum for home sales while the red line shows momentum for pending sales of single-family, re-sale homes. The purple line shows momentum for the median price.

This is an extraordinarily tough market for buyers. It's important to be calm and realistic. If you don't know what to do or where to begin, give me a call and let's discuss your situation and your options.

The real estate market is very hard to generalize. It is a market made up of many micro markets. For complete information on a particular neighborhood or property, call me.

If I can help you devise a strategy, call or click the buying or selling link in the menu to the left.

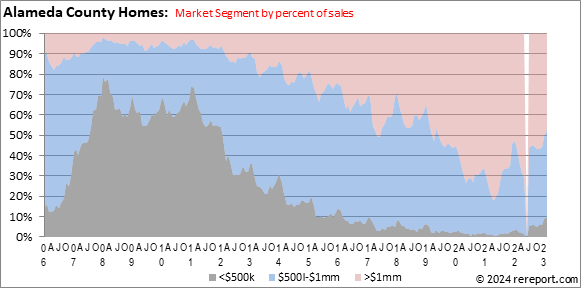

Complete monthly sales statistics for the Alameda County are below. Monthly graphs are available for each city in the county.

| May Sales Statistics | |||||||||||

| (Single-family Homes) | |||||||||||

| Prices | Unit | Change from last year | Change from last month | ||||||||

| Area | Median | Average | Sales | DOM | SP/LP | Median | Average | Sales | Median | Average | Sales |

| County | $1,350,000 | $1,458,918 | 705 | 22 | 106.9% | -1.8% | -2.9% | -9.0% | 0.0% | 0.1% | 4.4% |

| Alameda | $1,458,500 | $1,501,400 | 32 | 38 | 105.2% | 11.6% | 7.7% | 23.1% | 12.2% | 9.6% | 18.5% |

| Albany | $1,425,000 | $1,555,000 | 8 | 32 | 114.1% | 35.7% | 31.3% | 14.3% | 20.3% | 22.2% | 14.3% |

| Berkeley | $1,835,000 | $2,022,225 | 61 | 43 | 103.5% | 19.2% | 15.0% | 27.1% | 7.9% | 11.2% | 3.4% |

| Castro Valley | $1,338,000 | $1,392,638 | 33 | 43 | 102.6% | 7.0% | 5.0% | 26.9% | 1.0% | -2.7% | 6.5% |

| Dublin | $1,650,000 | $1,691,577 | 28 | 44 | 103.7% | -13.2% | -10.5% | -24.3% | -0.5% | -10.7% | 7.7% |

| Fremont | $1,751,000 | $1,967,114 | 91 | 38 | 109.6% | -3.7% | -3.4% | -1.1% | -5.2% | 2.6% | 19.7% |

| Hayward | $890,000 | $971,769 | 63 | 47 | 106.0% | -10.6% | -12.3% | -12.5% | -2.1% | -4.9% | 26.0% |

| Livermore | $1,300,000 | $1,370,403 | 67 | 45 | 102.2% | -2.0% | -4.8% | -8.2% | -2.3% | -11.1% | 8.1% |

| Newark | $1,449,500 | $1,449,098 | 20 | 51 | 107.5% | -3.4% | -6.0% | -25.9% | 2.7% | -2.4% | -4.8% |

| Oakland | $930,000 | $1,038,658 | 175 | 61 | 112.3% | -11.8% | -14.6% | -9.8% | -3.6% | -8.1% | -11.2% |

| Piedmont | $2,475,000 | $3,481,925 | 12 | 40 | 110.6% | -2.0% | 32.7% | 0.0% | -7.6% | 13.7% | 140.0% |

| Pleasanton | $1,685,000 | $2,003,239 | 43 | 50 | 101.9% | -9.4% | -5.4% | -18.9% | -6.7% | -0.2% | -17.3% |

| San Leandro | $900,000 | $977,027 | 33 | 44 | 105.5% | 2.0% | 1.5% | -25.0% | -0.9% | 0.3% | 22.2% |

| San Lorenzo | $837,500 | $814,623 | 16 | 43 | 104.6% | -2.0% | -4.5% | 45.5% | 1.5% | -0.7% | 23.1% |

| Union City | $1,523,000 | $1,631,401 | 21 | 40 | 108.1% | 1.4% | 13.9% | -19.2% | -1.7% | 6.5% | 0.0% |

| May Sales Statistics | |||||||||||

| (Condos/Town Homes) | |||||||||||

| Prices | Unit | Change from last year | Change from last month | ||||||||

| Median | Average | Sales | DOM | SP/LP | Median | Average | Sales | Median | Average | Sales | |

| County | $720,000 | $770,340 | 193 | 30 | 100.8% | -10.0% | -9.7% | -17.9% | -1.5% | -2.4% | -13.8% |

| Alameda | $875,000 | $823,891 | 11 | 45 | 111.0% | 7.4% | -3.3% | -35.3% | -15.0% | -4.7% | -31.3% |

| Albany | $507,000 | $604,375 | 4 | 131 | 96.2% | -19.5% | 3.5% | -33.3% | 13.0% | -5.2% | 100.0% |

| Berkeley | $820,000 | $868,700 | 10 | 45 | 107.7% | 30.7% | 33.0% | 150.0% | 9.2% | -0.8% | 0.0% |

| Castro Valley | $890,000 | $803,000 | 5 | 73 | 95.0% | 37.0% | 3.1% | -16.7% | 1.5% | 10.9% | 25.0% |

| Dublin | $1,015,000 | $970,989 | 17 | 37 | 99.9% | 20.5% | 7.9% | 21.4% | 8.2% | 18.7% | -41.4% |

| Emeryville | $385,000 | $415,564 | 11 | 72 | 97.8% | -11.5% | -17.9% | 22.2% | -21.5% | -27.3% | 10.0% |

| Fremont | $970,000 | $945,671 | 35 | 52 | 99.0% | -4.2% | -6.8% | -23.9% | -2.0% | 14.3% | -5.4% |

| Hayward | $635,000 | $614,175 | 22 | 64 | 100.8% | -20.6% | -17.9% | 4.8% | -15.3% | -19.1% | 29.4% |

| Livermore | $820,000 | $798,533 | 15 | 46 | 100.5% | 13.5% | 4.6% | -37.5% | 9.0% | 1.7% | 25.0% |

| Newark | $790,000 | $880,363 | 8 | 59 | 103.5% | -27.0% | -14.5% | -20.0% | -11.2% | -26.2% | -33.3% |

| Oakland | $553,000 | $599,028 | 34 | 77 | 100.4% | 5.3% | -4.4% | 0.0% | -2.6% | -8.6% | -27.7% |

| Pleasanton | $955,500 | $944,667 | 12 | 46 | 98.9% | 0.4% | 2.8% | 20.0% | 39.5% | 43.4% | 20.0% |

| San Leandro | $633,000 | $649,000 | 4 | 69 | 101.1% | 36.1% | 17.3% | -42.9% | 22.4% | 18.0% | -50.0% |

| Union City | $550,000 | $697,000 | 5 | 56 | 101.8% | -41.7% | -22.5% | -28.6% | -8.6% | -31.7% | -50.0% |

May 30, 2025 --

Since the announcements of significant tariffs on U.S. trading partners, rather

a lot has changed. Advance ordering to avoid expected higher costs distorted the

calculation of first quarter GDP, turning it negative, even though underlying

economic fundamentals still seem solid enough. Even so, worries about a future

downturn became elevated. Consumer and business moods turned truly dark and

inflation expectations spiked. Overarching these and other issues is a broad

sense of uncertainty, as expectations for trade policy and any ultimate impact

on inflation and the broader economy continue to evolve, seemingly as often as

every day.

That's unfortunate, since absent the upheaval the imposition of new or expanded

levies we'd likely be in a situation where solid growth amid fading inflation

might have seen the Fed feeling comfortable about making a cut to short-term

interest rates at the coming June meeting. However, with the on-again,

off-again, larger-then-smaller (and larger again?) nature of the imposition of

new tariffs, there's simply no way for the Fed or anyone else to develop a good

sense of what the outcome will be. As such, the Fed is resigned to holding

policy steady and waiting for clues and signs.

Consumer Confidence rose 12.3 points to 98.0 in May, its best showing since

February. Current conditions were assessed to be somewhat more favorable,

posting a 4.8 point gain to 135.9 while the outlook enjoyed a greater burst of

optimism, powering 17.4 points higher to rise to 72.8 for the month. Inflation

expectations here also moderated a bit, with the May expectation halving the

increase over the last two months, and the half-point decline leaving it at a

flat 6.5%. Consumer plans to buy new vehicles pushed higher, reaching their

highest mark since last May, while those to buy homes rebounded to a level last

seen in December 2022. The increase in plans to buy a home in the Conference

Board's survey seems rather at odds with other observations. Of course, plans to

do something aren't exactly a firm commitment, either. Firm commitments come in

the form of signed contracts to buy, and unfortunately, there were rather fewer

of those in April. The National Association of Realtors Pending Home Sales Index

(PHSI) declined by 6.3% in April, and this decline will impact existing home

sales figures for May and June. We discussed the spring housing market in last

week's MarketTrends,

and it doesn't look as though the start of the summer will be much improved.

New applications for mortgage credit slid again in the week ending May 23. The

Mortgage Bankers Association reported a 1.2% decline in requests for mortgage

funds, with the top-line figure pulled down by a 7.1% reduction in applications

to refinance existing mortgages but lifted by a 2.7% increase in those for funds

to buy homes. Perhaps some of the optimistic planners in the Conference Board's

survey decided to jump in, after all.

More folks would jump in to the market if mortgage rates were more favorable,

but conditions just don't support those at the moment. Absent all the tariff

uncertainty there would still be concerns about deficits and debts, budgets and

more, but the outlook for the economy and inflation would probably not be among

them. Modest growth and easing price pressures are a recipe for the Fed

gradually moving policy back toward a neutral stance, and such signals would

help longer-term rates to find at least some space to gradually decline.

Unfortunately, those days and times aren't now, and uncertainty is preventing

the opportunity for lower interest rates to help energize the housing market.

Perhaps the dust will settle somewhat as the summer progresses, and the size and

shape of the levies will become better known; if so, this may allow for monetary

policy to start to be adjusted gradually downward. This would be far preferable

to the outcomes the Fed's staff outlined in the minutes. Until then, we'll just

wade through and wait out the uncertainty.

Mortgage rates will likely retreat a little next week, at least based on market

conditions at the end of this one. However, the decline will probably be only

enough to erase this week's modest increase or perhaps a little more. The data

spigot opens full blast again next week with the first-of-the-month cascade, but

surprises (if any) seem more likely to be to the downside than up. As such, we

think that the average offered rate for a conforming 30-year fixed-rate mortgage

as reported by Freddie Mac will decline by 4-6 basis points.

This page is copyrighted by https://rereport.com. All rights are reserved.