Statistical Tables | | After Quiet, Data Deluge

| Trends at a Glance | |||

| (Single-family Homes) | |||

| Nov 25 | Oct 25 | Nov 24 | |

| Home Sales: | 181 | 264 | 200 |

| Median Price: | $1,490,000 | $1,499,000 | $1,563,500 |

| Price: | $2,167,433 | $2,236,538 | $2,068,730 |

| SP/LP: | 98.6% | 98.9% | 106.4% |

| Days on Market: | 25 | 24 | 29 |

| (Lofts/Townhomes/TIC) | |||

| Nov 25 | Oct 25 | Nov 24 | |

| Condo Sales: | 206 | 301 | 208 |

| Median Price: | $1,130,000 | $1,149,000 | $1,120,000 |

| Average Price: | $1,317,052 | $1,310,239 | $1,284,629 |

| SP/LP: | 99.3% | 95.9% | 98.5% |

| Days on Market: | 56 | 46 | 65 |

The median sales price for single-family, re-sale homes was down 8.6%

year-over-year.

The average sales price for single-family, re-sale homes was down 2.4%

month-over-month. Year-over-year, it was up 20.2%.

Sales of single-family, re-sale homes rose 19.2% year-over-year. There were 149

homes sold in San Francisco last month. The average since 2000 is 214.

The median sales price for

condos/lofts

was up 4.7% year-over-year.

The average sales price was up 8.3% year-over-year.

Sales of

condos/lofts

rose 18.5% year-over-year. There were 192

condos/lofts

sold last month. The average since 2000 is 230.

The sales price to list price ratio, or what buyers are paying over what sellers

are asking, fell from 98.6% to 98.5% for homes. The ratio for condos/townhomes

fell from 99.3% to 97.2%.

Average days on market, or the time from when a property is listed to when it

goes into contract, was 28 for homes and 68 for condos/lofts.

Sales momentum…

for homes rose from +4.3 to +4.8. Sales momentum for condos/lofts was up 0.9 of

a point to +15.3.

Pricing momentum…

for single-family homes fell 1.2 points to -3.6. Pricing momentum for

condos/lofts was flat at –4.4.

Our momentum statistics are based on 12-month moving averages to eliminate

monthly and seasonal variations.

If you are planning on selling your property, call me for a free comparative

market analysis.

momentum by using a 12-month moving average to eliminate seasonality. By comparing this year's 12-month moving average to last year's, we get a percentage showing market momentum.

the blue area shows momentum for home sales while the red line shows momentum for pending sales of single-family, re-sale homes. The purple line shows momentum for the average price.

As you can see, pricing momentum has an inverse relationship to sales momentum.

The graph below shows the median and average prices plus unit sales for homes.

Remember, the real estate market is a matter of neighborhoods and houses. No two are the same. For complete information on a particular neighborhood or property, call me.

P.S. The FHA requires all condo projects to be re-certified before they will make a loan. To find out if the condo project you're interested in is eligible, go here: https://entp.hud.gov/idapp/html/condlook.cfm.

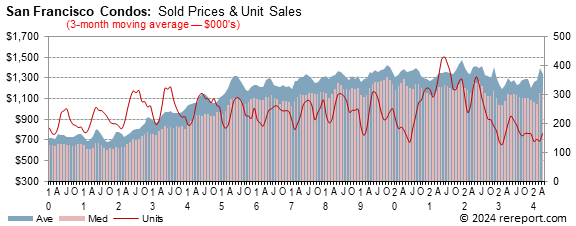

The graph below shows the median and average prices plus unit sales for condos/lofts.

The real estate market is very hard to generalize. It is a market made up of many micro markets. For complete information on a particular neighborhood or property, call me.

If I can help you devise a strategy, call or click the buying or selling link in the menu to the left.

Complete monthly sales statistics for San Francisco are below. Monthly graphs are available for each area in the city.

| December Sales Statistics | |||||||||||

| (Single-family Homes) | |||||||||||

| Prices | Unit | Yearly Change | Monthly Change | ||||||||

| Median | Average | Sales | DOM | SP/LP | Median | Average | Sales | Median | Average | Sales | |

| San Francisco | $1,398,000 | $2,115,309 | 149 | 28 | 98.5% | -8.6% | 20.2% | 19.2% | -6.2% | -2.4% | -17.7% |

| D1: Northwest | $2,227,500 | $2,270,888 | 10 | 32 | 118.2% | 23.6% | 8.7% | 25.0% | 4.6% | -14.9% | -44.4% |

| D2: Central West | $1,695,000 | $1,708,120 | 25 | 18 | 126.3% | 7.3% | 7.5% | 13.6% | -0.8% | -4.1% | -28.6% |

| D3: Southwest | $1,275,000 | $1,454,583 | 12 | 30 | 113.1% | -9.7% | 2.6% | 100.0% | -3.8% | -3.5% | 20.0% |

| D4: Twin Peaks | $1,817,500 | $1,945,759 | 26 | 14 | 114.7% | 13.6% | 15.4% | 36.8% | -18.9% | -17.2% | 0.0% |

| D5: Central | $3,487,500 | $3,917,250 | 16 | 27 | 103.4% | 48.9% | 57.3% | 14.3% | 34.3% | 15.4% | -38.5% |

| D6: Central North | $0 | $0 | 0 | 0 | 0.0% | n/a | n/a | n/a | n/a | n/a | n/a |

| D7: North | $5,997,000 | $6,712,400 | 10 | 44 | 94.4% | 23.6% | 33.7% | 100.0% | 11.1% | -8.4% | 25.0% |

| D8: Northeast | $11,300,000 | $11,300,000 | 1 | 44 | 90.4% | 242.4% | 23.3% | -66.7% | 167.5% | 148.6% | -66.7% |

| D9: Central East | $1,580,000 | $1,824,647 | 17 | 54 | 106.9% | 1.8% | 12.3% | -15.0% | -4.2% | 2.3% | -10.5% |

| D10: Southeast | $975,000 | $1,018,691 | 33 | 37 | 108.8% | -8.5% | -9.2% | -13.2% | -5.8% | -4.7% | 0.0% |

| December Sales Statistics | |||||||||||

| (Condos/TICs/Co-ops/Lofts) | |||||||||||

| Prices | Unit | Yearly Change | Monthly Change | ||||||||

| Median | Average | Sales | DOM | SP/LP | Median | Average | Sales | Median | Average | Sales | |

| San Francisco | $1,095,000 | $1,392,940 | 192 | 68 | 97.2% | 4.7% | 8.3% | 18.5% | -3.1% | 5.8% | -6.8% |

| D1: Northwest | $1,475,000 | $1,412,625 | 8 | 51 | 105.7% | 5.4% | 10.0% | 60.0% | 3.4% | 1.9% | -42.9% |

| D2: Central West | $457,596 | $457,596 | 2 | 84 | 100.0% | -75.0% | -75.0% | 0.0% | -64.8% | -64.6% | -50.0% |

| D3: Southwest | $1,010,000 | $983,125 | 4 | 48 | 111.1% | 90.6% | 32.6% | 33.3% | 13.5% | 10.5% | 100.0% |

| D4: Twin Peaks | $547,500 | $547,500 | 2 | 244 | 94.6% | -20.4% | -20.4% | 0.0% | -58.7% | -58.7% | 100.0% |

| D5: Central | $1,500,000 | $1,497,320 | 25 | 44 | 104.2% | 12.1% | 15.4% | 4.2% | 0.0% | -0.6% | -13.8% |

| D6: Central North | $1,275,000 | $1,340,655 | 20 | 56 | 102.9% | 7.8% | 15.6% | 66.7% | 6.9% | 5.6% | -16.7% |

| D7: North | $1,627,500 | $2,822,381 | 22 | 54 | 94.9% | 20.6% | 88.6% | 15.8% | -16.3% | 36.4% | -15.4% |

| D8: Northeast | $900,000 | $1,228,281 | 41 | 81 | 97.9% | -2.7% | -1.7% | 32.3% | -10.4% | 4.1% | -10.9% |

| D9: Central East | $912,500 | $1,087,397 | 62 | 76 | 100.5% | -3.9% | -22.4% | 17.0% | 1.4% | -9.8% | 12.7% |

| D10: Southeast | $781,200 | $864,567 | 6 | 76 | 99.5% | 5.6% | 15.3% | -45.5% | 10.0% | 20.1% | 20.0% |

January 2, 2026 --

The hustle and bustle of the holiday season is coming to a close, and the quiet

which pervades financial markets over this time each year is also complete. The

streams of data which track various components of the economy aren't fully back

to normal as yet, and the coming month will reveal a lot about how things ended

the year. As the government remained partially shuttered through nearly

mid-November, data from December will be the first that has no direct shutdown

distortion since back in September.

The first full week of January seems to be a time when changes in trends for

interest rates often begin. Not only does the quiet holiday trading in financial

markets return to normal, it's also the start of both a new quarter and new

calendar year, and so there's usually also some re-setting of investment

positions and strategies. As well, to start the month and year, there's a fresh

slug of new economic data to help investors monitor any changes in momentum or

existing trends.

We expect to see some pickup in home sales this year (see HSH's

Annual Outlook for 2026 for

a discussion) and it would appear that the recent trend is supportive of that.

In the last few months, the Pending Home Sales Index from the National

Association of Realtors has trended upward, and November's measure of signed

contracts to buy existing homes rose by another 3.3%. The current value of this

index is the highest it has been dating back to February 2023, and there have

been gains in each of the last four months. While lower mortgage rates have

helped lift sales, it's not solely about rates, since there was a 4.2% increase

in this index way back in August, when 30-year FRMs still averaged better than

6.5%. Lower rates have helped improve sales, but so has more homes available to

buy, rising incomes and flattening home price increases.

Mortgage rates start 2026 as low as they have been since October 3, 2024. If

they should hang around such levels for a while after the holiday fog clears,

some additional potential homebuyers are likely to take notice. More attractive

noise would be made if rates could manage to decline about eight more basis

points from this week's level, as this would put them at more than a three-year

low (September 15, 2022). After that, headline-worthy "lowest since" comparisons

will become hard to come by, as even a decline that cracks the 6% mark at some

point will still only improve the historical reference by a single week.

It's worth noting that much of the decline in mortgage rates has come from the

narrowing in spreads, which have currently reached their smallest gap since

March 2022 at just 202 basis points last week. Looking over time, on an annual

basis, the average yield on the 10-year Treasury for 2023 was 3.96% and the

average spread to conforming 30-year FRMs was 285 basis points. For 2024, it was

4.21% and 251 basis points, and for 2025, 4.29% and 230. On average, and for a

variety of reasons, the influential yield on the 10-year Treasury actually has

been rising in the aggregate but the spread to mortgage rates shrinking, with

the 55 basis point decline in spreads in the last few years overcoming the

33-point rise in yield over this stretch of time. Of course, such broad

comparisons don't tell us all that much, but if nothing else it is a clear

reminder that there are other forces at work in setting mortgage rates beyond

Treasury yields and Fed policy moves.

This page is copyrighted by https://rereport.com. All rights are reserved.